Focus: Retirement Savings

Retirement savings have a particular purpose:

To provide an income when we are unable (or do not want) to work for everyday living expenses anymore.

When investing for retirement income the portfolio and the asset allocation have to be designed to beat the rise in living costs. Not in a “it will sort itself out” kind of way. But explicit. Purposeful.

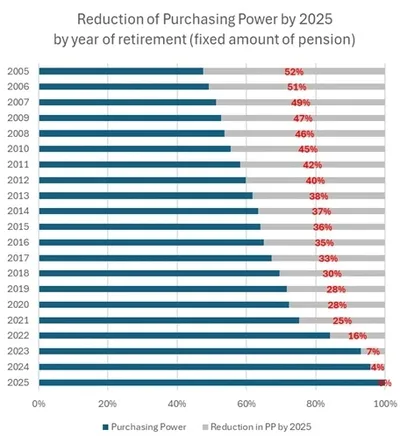

Challenge 1: Living expenses grow with inflation

The standard ways to invest for retirement do not account for this fact. Pension Funds and asset managers talk about their nominal returns. They may even invest in inflation linked bonds. But inflation linked bonds historically have in fact not generated returns in line with inflation.

Asset managers are compared to benchmarks, which usually do not account for the dynamics of the actual investment goal.

Challenge 2: Future returns are hard to predict

As a result most pension saving strategies rely on a simple or completely static asset allocation. Contrary to that, it is intuitive that asset allocation should take the current, relative price of assets into account.

In the academic literature it has also been shown that dynamic allocation led — historically — to better results.

What’s missing?

There is little guidance available on how to address these challenges.

Matthex Advisors is developing solutions and tools leading to specific asset allocations, which take the development of living expenses and relative asset prices into account.

Ready to explore?

Learn how our approach calibrates your allocations to keep pace with evolving living costs.